Does Bankruptcy Make Sense for Your Financial Situation?

Does bankruptcy make sense for your financial situation? Deciding if you should file for bankruptcy is never easy. The process takes time, costs money, and you are already struggling financially. When you file for bankruptcy, you lose control of how your assets and finances are handled. While there are reasons keeping you from filing for…

Common Bankruptcy Myths Finally Debunked

Do you know the common bankruptcy myths? No one goes through life planning to file bankruptcy. Even those who know they need to file for bankruptcy have developed such a misguided view of this legal tool that they fear doing so. Bankruptcy is nothing to fear, and you should not give into the stigmas surrounding…

What Happens to a Jointly Owned Home in Bankruptcy?

The joint-owned property, such as that owned by a married couple, can affect how a bankruptcy is completed. If one spouse is going to file for bankruptcy, but there are assets in both of your names, it is imperative you speak with an attorney about these properties; especially when it comes to the family home….

5 Steps to Bankruptcy Planning

If you are considering bankruptcy, planning is essential. The actions you take, weeks and even months before you file, could dramatically impact the outcome of your case. Regardless of how bad your financial situation is, the more steps you take ahead of time, the better the outcome will be for your case – and the…

7 Steps to a Successful Bankruptcy

When you find yourself over your head with debt, and you can no longer meet your payment obligations, you might look to bankruptcy. Bankruptcy is a legal remedy for consumers who need a fresh start and relief from creditors and collection agencies. However, it is a serious financial decision that will impact your financial health…

How to Avoid Filing a Second Bankruptcy in the Future

No one goes through life expecting to file bankruptcy. However, it happens for some consumers. Whether it is a medical emergency, job loss, or another incident that forces you to fall behind and eventually seek help from the courts, bankruptcy is there for consumers who cannot satisfy obligations. Unfortunately, some consumers end up filing bankruptcy…

Warning Signs that Bankruptcy is on the Horizon for You

No one goes through life expecting to file bankruptcy, but it happens. Sometimes, the warning signs are clear, while other times they are not so obvious. Regardless of your financial situation – or what you assume it will be like in the future – it is imperative that you know the warning signs of bankruptcy….

Will My Tax Refund be Affected by My Bankruptcy Case?

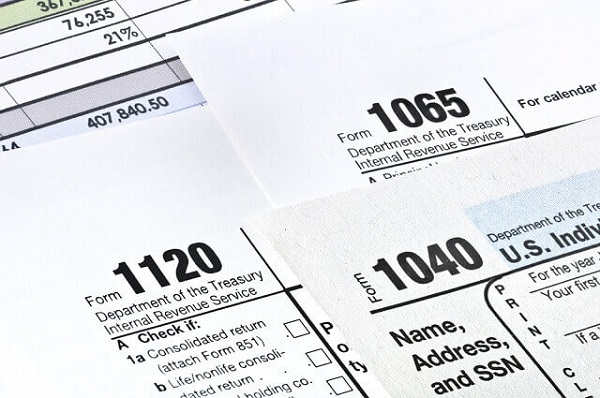

It is tax season, which means that you are probably anxiously awaiting your tax refund check. But, if you are in the process of bankruptcy, or if you have filed bankruptcy and you are in the repayment process, you might wonder what happens to your federal or state tax returns. If you have filed Chapter…

Can You Lower a Car Payment in Bankruptcy?

You file for bankruptcy because you can no longer manage your debts. Whether it is because you lost your job or took a significant cut in pay, you need to eliminate monthly debt obligations to get back on your feet. But you need to keep your car. It is how you take the kids to…