Does Bankruptcy Make Sense for Your Financial Situation?

Does bankruptcy make sense for your financial situation? Deciding if you should file for bankruptcy is never easy. The process takes time, costs money, and you are already struggling financially. When you file for bankruptcy, you lose control of how your assets and finances are handled. While there are reasons keeping you from filing for…

Common Bankruptcy Myths Finally Debunked

Do you know the common bankruptcy myths? No one goes through life planning to file bankruptcy. Even those who know they need to file for bankruptcy have developed such a misguided view of this legal tool that they fear doing so. Bankruptcy is nothing to fear, and you should not give into the stigmas surrounding…

7 Steps to a Successful Bankruptcy

When you find yourself over your head with debt, and you can no longer meet your payment obligations, you might look to bankruptcy. Bankruptcy is a legal remedy for consumers who need a fresh start and relief from creditors and collection agencies. However, it is a serious financial decision that will impact your financial health…

How to Avoid Filing a Second Bankruptcy in the Future

No one goes through life expecting to file bankruptcy. However, it happens for some consumers. Whether it is a medical emergency, job loss, or another incident that forces you to fall behind and eventually seek help from the courts, bankruptcy is there for consumers who cannot satisfy obligations. Unfortunately, some consumers end up filing bankruptcy…

Will My Tax Refund be Affected by My Bankruptcy Case?

It is tax season, which means that you are probably anxiously awaiting your tax refund check. But, if you are in the process of bankruptcy, or if you have filed bankruptcy and you are in the repayment process, you might wonder what happens to your federal or state tax returns. If you have filed Chapter…

Can You Lower a Car Payment in Bankruptcy?

You file for bankruptcy because you can no longer manage your debts. Whether it is because you lost your job or took a significant cut in pay, you need to eliminate monthly debt obligations to get back on your feet. But you need to keep your car. It is how you take the kids to…

What Are the Bankruptcy Exemptions for Chapter 11 and Chapter 13?

Each form of bankruptcy works in its own way, with Chapters 7, 11, and 13 differing from one another substantially. One of the biggest differences is how exemptions are applied when it comes to your personal property. What are the bankruptcy exemptions for Chapter 11 and Chapter 13? Chapter 11 Filing for Chapter 11 means…

What is a Proof of Claim in a Bankruptcy Case?

What is a proof of claim in a bankruptcy case? It is a written statement that tells the court, the debtor, and the trustee, along with other interested parties, that a creditor will exercise the right to receive a payout from the bankruptcy estate. In a Chapter 7 or Chapter 13 consumer bankruptcy case, when…

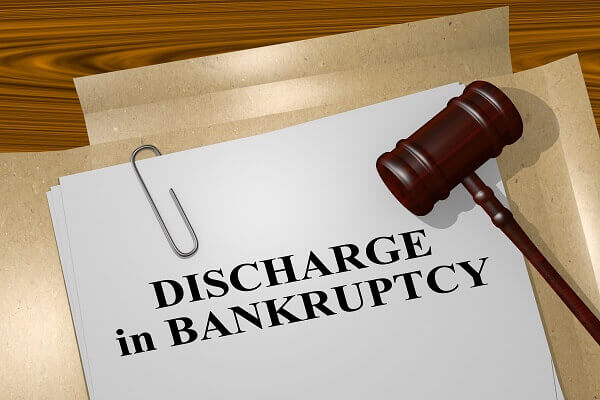

What is a Bankruptcy Discharge and When Does It Happen?

What is a Bankruptcy discharge? At the end of your bankruptcy, you receive a discharge. This is a court order that is used for Chapter 7 and Chapter 13 bankruptcies, and it relieves you from debt obligations associated with the bankruptcy case. To receive a discharge from the court, you must satisfy all requirements. Once…

Using Bankruptcy to Manage Your Tax Burden: Is It Possible?

Can you use bankruptcy to manage your tax burden? Heavy tax burdens, whether it is past due state taxes or taxes due to the Internal Revenue Service (IRS), are stressful for any consumer. For most cases of tax debt, you cannot discharge those taxes through bankruptcy. While this sounds discouraging, you still have options for…