7 Steps to a Successful Bankruptcy

When you find yourself over your head with debt, and you can no longer meet your payment obligations, you might look to bankruptcy. Bankruptcy is a legal remedy for consumers who need a fresh start and relief from creditors and collection agencies. However, it is a serious financial decision that will impact your financial health…

How to Avoid Filing a Second Bankruptcy in the Future

No one goes through life expecting to file bankruptcy. However, it happens for some consumers. Whether it is a medical emergency, job loss, or another incident that forces you to fall behind and eventually seek help from the courts, bankruptcy is there for consumers who cannot satisfy obligations. Unfortunately, some consumers end up filing bankruptcy…

Warning Signs that Bankruptcy is on the Horizon for You

No one goes through life expecting to file bankruptcy, but it happens. Sometimes, the warning signs are clear, while other times they are not so obvious. Regardless of your financial situation – or what you assume it will be like in the future – it is imperative that you know the warning signs of bankruptcy….

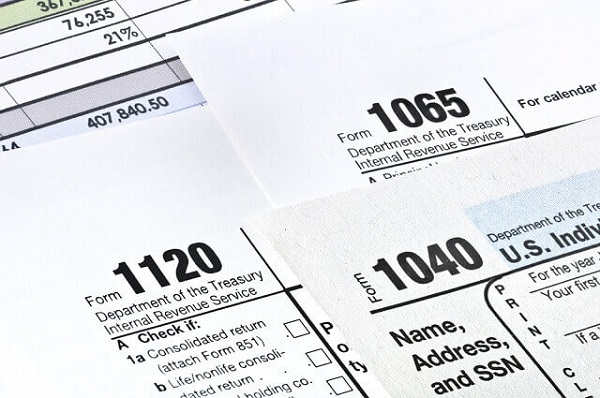

Will My Tax Refund be Affected by My Bankruptcy Case?

It is tax season, which means that you are probably anxiously awaiting your tax refund check. But, if you are in the process of bankruptcy, or if you have filed bankruptcy and you are in the repayment process, you might wonder what happens to your federal or state tax returns. If you have filed Chapter…

Can You Lower a Car Payment in Bankruptcy?

You file for bankruptcy because you can no longer manage your debts. Whether it is because you lost your job or took a significant cut in pay, you need to eliminate monthly debt obligations to get back on your feet. But you need to keep your car. It is how you take the kids to…

Will Bankruptcy Save My Home from Foreclosure?

Will bankruptcy save your home from foreclosure? Most homeowners facing bankruptcy are worried about one thing — the family home. Are you significantly behind on mortgage payments and struggling to meet debt obligations? If your mortgage lender is threatening to foreclose, bankruptcy might be your only option. With the protections of bankruptcy, you could prevent…

Insolvency Versus Bankruptcy: What is the Difference?

Insolvency and bankruptcy are often confused. While both apply to a business struggling to pay its obligations, each has different processes and outcomes. What is Insolvency? Insolvency is considered a financial status. It means that a business cannot promptly pay its obligations. According to the Internal Revenue Service (IRS), a business is insolvent when the…

What is Pre-Bankruptcy Counseling?

Most bankruptcy cases require that you have credit counseling, or pre-bankruptcy counseling, in a specified number of days before you can file the bankruptcy protection order in court. You will also be required to complete a course on debt management before your debts are discharged. This is the court’s way of ensuring that you learn…

What Are the Bankruptcy Exemptions for Chapter 11 and Chapter 13?

Each form of bankruptcy works in its own way, with Chapters 7, 11, and 13 differing from one another substantially. One of the biggest differences is how exemptions are applied when it comes to your personal property. What are the bankruptcy exemptions for Chapter 11 and Chapter 13? Chapter 11 Filing for Chapter 11 means…